Part 4: investing early, consistently, and keeping it simple

- Vimal Fernandez

- Oct 3, 2025

- 6 min read

Updated: Oct 12, 2025

Disclosure: I’m not a financial advisor. This isn’t financial advice — just what worked for our family. Your financial journey is yours to chart.

Investing is like parenting: it’s slow, messy, and you won’t know if you did it right for about 20 years. Good luck! 🍼📈😅

Now that we had our ‘why’ defined, tracking around our finances, and some solid goals for savings and net worth, it was time to make sure we were investing correctly to reach them.

Our strategy was rooted in simplicity. Sure, we could chase a little extra gain here or a little less volatility there, but that just complicates things. A simple plan is easier to stick with, and for us, it worked just as well.

Our asset allocation is simple: 100% US equities

We invest in S&P 500 index funds that are made up of 100% US equities. This means we own pieces of thousands of successful companies like Apple, McDonalds, and Pfizer.

Other strategies exist—picking individual stocks, mixing in bonds, adding foreign exposure—but for us, keeping it simple with S&P 500 funds eliminated a ton of headaches. No rebalancing. No guessing when to sell. No figuring out a bond strategy. Just buy one fund.

Sure, some say this is “too risky”, but our take was since we were still working and wouldn’t be touching the money for years, we had time to ride out volatility—even a 50% market drop in US equities. History shows recessions usually bounce back in a year or two. Plus, owning 500 companies spread across industries is way less risky than trying to bet on a handful of individual stocks. And if the worst happened and we both lost our jobs during a downturn, we had an emergency fund (+ unemployment) to cover us.

On the reward side, this strategy gave us some big gains. We’ve been invested in the S&P 500 for the last 15 years and it has been a solid bull market. Yes, we might’ve gotten lucky. Nobody knows what the market will do. But over those years, the average return of the S&P 500 was about 14%.

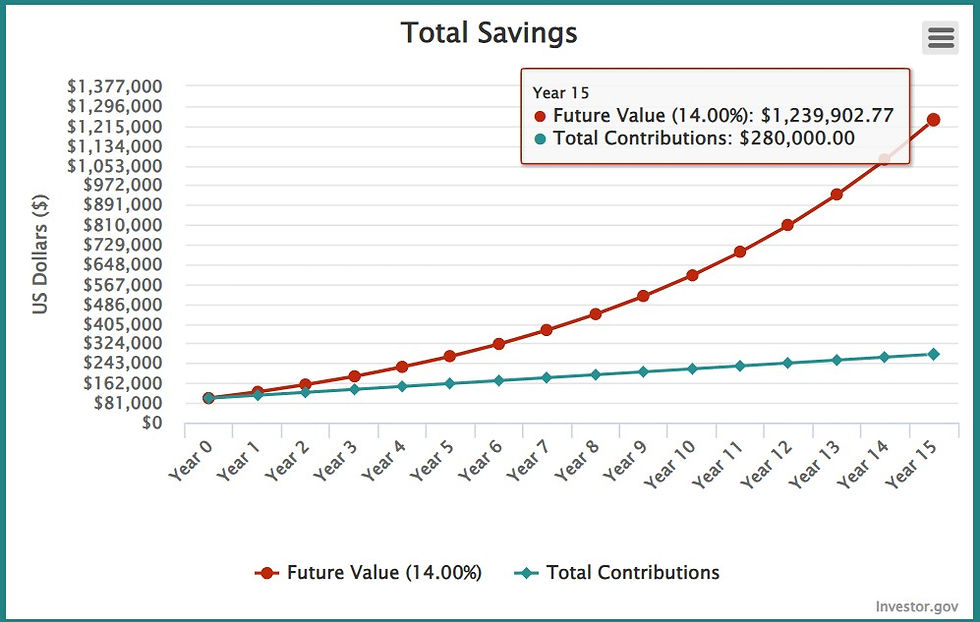

I modeled what a 14% return looks like using investor.gov:

Start with $100k.

Add $1k a month.

Compound for 15 years @ 14%.

The result: this portfolio grew by over $900k, reaching $1.2M—a 330% gain!

Yay America! 🦅 Past performance doesn’t guarantee future performance, but these types of gains aren’t that uncommon with US equities.

Which index funds, specifically?

We invest in simple, boring, low-cost index funds based in the US:

Total market ETFs (VTI, SCHB)

S&P 500 ETFs (VOO, IVV)

Sometimes our accounts (401k’s, HSAs, 529s) don’t allow ETFs, so we found similar mutual funds (SWTSX, SNXFX, FXAIX, VTSAX).

Why index funds work for us:

Low cost (0.03% expense ratios)

Self-cleansing (bad companies get booted, good companies get added)

No need to figure out when to buy or sell (unlike with individual stocks, where you need buy/sell targets)

Truly passive (buy and hold, baby!)

Strong historical risk/reward (the S&P 500 has averaged 10% a year over the last 30 years)

Warren Buffet said so: “Consistently buy an S&P 500 low-cost index fund. Keep buying it through thick and thin, and especially through thin.”

Quick tax tips:

Not all dividends are created equal. S&P 500 funds throw off mostly qualified dividends that are taxed at more favorable long-term capital gains rates. Funds like SWTSX, VOO, and VTI usually deliver 95%+ qualified dividends, lowering our tax burden.

We do dabble in more advanced strategies like tax-loss harvesting and capital gains harvesting. More on that in a future post.

Investing early: let compounding do the heavy lifting

I’m not big on working harder than I need to. Investing was no exception. If there’s a “set it and forget it” path to solid returns, I’m in.

Enter: compound interest.

Compounding seems lame AF at first. Slow. Boring. Like, why even bother when it feels like nothing’s happening? But then, over time, your money earns money. And then that money starts earning money too. And then that money that started earning money then starts earning money on top of that other money and then you get even more money. Get it? Eventually, it snowballs, turning small, consistent investments into serious FU money.

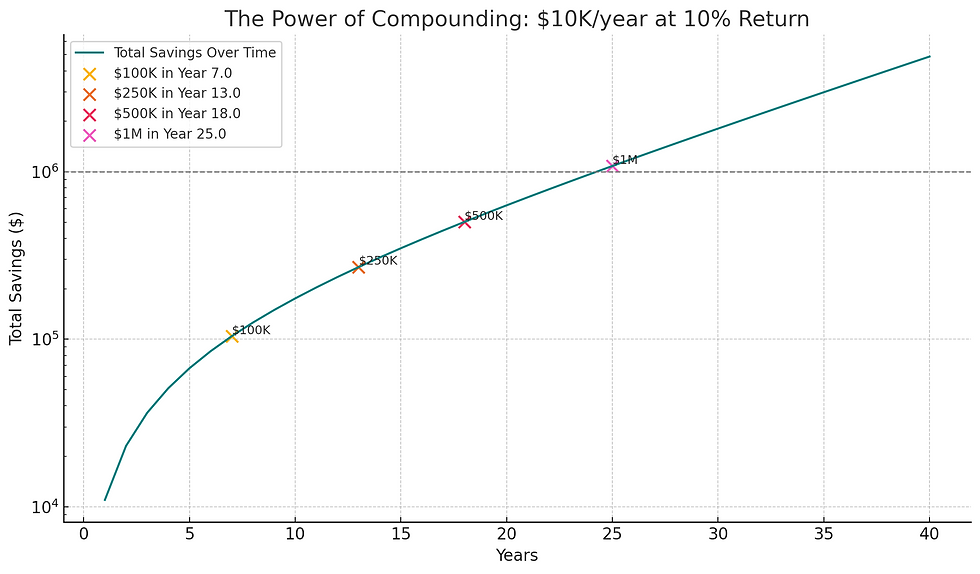

I made this chart to help me understand this better. I wanted to see how long it would take to hit $1M by investing $10k a year with a 10% return (long-term return of the S&P 500).

A few realizations:

It takes ~25 years to hit $1M at $10k/year with a 10% return.

It takes 7 years to hit $100k. That’s the slog. That’s the “what’s the point, why don’t we just buy that boat” phase.

But if you stick with it, in the final 7 years, $500k turns into $1M! That’s when you feel like the Wolf of Wall Street and just wanna flip a table.

And if you up the investment to $50k/year, you can hit $1M in a little over 10 years.

That’s the magic of compounding: slow at first, then flip-the-table explosive.💥

Investing consistently: dollar-cost averaging

Every month we saved money, and like clock work, we invested it right into those S&P 500 funds. Sometimes it was automatic like through our 401ks. Other times it was manual like buying more VOO in our brokerage account.

Little did we know, but this is called dollar-cost averaging (DCA). It’s a simple strategy where you invest an amount on a regular schedule, no matter what the market is doing.

The chart below shows how DCA helps take advantage of market fluctuations. By investing consistently, I naturally bought more shares when prices were low and fewer when prices were high. Over time, this brought down my average cost per share.

In this example, DCA ends up with a higher percentage gain (52% vs 20%)—not because of timing the market, but because we kept buying through the ups and downs without overthinking it. We DCA’d twice a month with every paycheck and then let time in the market do the heavy lifting.

Keeping with the theme of simplicity, this was easy for us. We just bought the same fund over and over. No picking stocks, no rebalancing, no overthinking. Just blindly buying our favorite S&P 500 index ETF again and again.

No matter what, stay invested

We tried hard to ignore the noise:

No meme stocks.

No panic selling.

No market timing.

No Jim Cramer.

The chart below shows why trying to time the market is a losing game. Over the past 25 years, staying fully invested in the S&P 500 earned about 12% per year. But if we missed just the 10 best days, our return was cut in half. If we missed 30 of the best days, our return would barely beat inflation.

Those best days often happen right after big drops—exactly when people panic sell and sit on the sidelines. We don’t try to guess the market. We stay invested, keep buying, and let time do the work.

But, you know, we ain’t perfect. I did try and play with crypto, and it's still sitting there going through a rollercoaster ride. #fartcoin

Keeping it simple, investing early and consistently

I think the pros make investing seem harder than it needs to be—mostly because they want to charge us fees. But investing doesn’t have to be complicated, and it definitely doesn’t need to be over-optimized just to squeeze out every last drop of return. Investing early and often, dollar-cost averaging, compounding, and staying out of the market-timing game is what supercharged our path to FI.

For us, 100% US equities made sense. It was simple to manage, it scaled with our life, we accepted the risk, and it delivered solid returns. And here’s one last stat to drive it home: over a 15-year period, ~90% of U.S. large-cap fund managers underperformed the S&P 500. If they can’t beat it, there’s no way I could.

If you want a solid breakdown of why this approach works, The Simple Path to Wealth by JL Collins explains it better than I ever could.

Next up: Boosting our savings rate

This post is part of our 'journey to early retirement' series, sharing our path to Financial Independence (FI) and early retirement with kids.

AI epilogue:

This topic was a good one to brainstorm with AI.

Prompt:

Can you walk me through some questions to figure out what the best investing strategy for me is?

Comments