Part 5: boosting our savings rate

- Vimal Fernandez

- Oct 12, 2025

- 7 min read

Updated: Oct 24, 2025

Disclosure: I’m not a financial advisor. This isn’t financial advice — just what worked for our family. Your financial journey is yours to chart.

Ok, where we at? We nailed down our fundamentals: our ‘why’, our tracking systems, and our goals. We know how we’re investing, and the risks we’re willing to take on. But we still had about 8 years ahead of us until hitting Financial Independence (FI).

During that time, we knew expenses would creep up (three kids will do that) and inflation wasn’t slowing down. So we needed to keep up our savings rate to stay on track to FI.

Our goal was an after-tax savings rate of 50%

This might sound like a lofty goal—and it was. But we’ll break down how we actually pulled it off below. We didn’t aim to save much more than 50%, because spending money brings us joy and makes the journey worth it. As we’ve shared before, the biggest gains come as you approach that 50% mark. Saving more might shave a year or two off our FI timeline, but at what cost? We’d rather enjoy the ride while still crossing the finish line.

When it comes to reaching FI, nothing moves the needle more than our savings rate—and that’s the one thing fully within our control.

Increasing our savings rate (without hating life)

1. Maximize income through work perks, career moves, and real estate

Work perks:

We took advantage of every damn work perk under the sun. The issue with this stuff is that we had to dig to uncover these benefits, and redeeming them is often a hassle. But it’s free money and it adds up. Here are some of our employer perks we took advantage of:

401k employer match: 5%

ESPP: 15% discount on company stock that you can sell the day it grants

HSA contributions: $1.5k for doing health tests

Childcare: $5k FSA tax deduction, 10 free days of in-home backup care

Random reimbursements: gym, cell phone, Wi-Fi, soccer

Legal benefit: free trust setup

Healthcare subsidies: hospital reimbursement for childbirth

Time off: sick, volunteer, vacation, and flex days

Counseling: 8 free visits

Financial planning: free consults

These benefits totaled $40k+ of “free” money a year. This ain’t small change!

Career moves:

We increased our total comp by 3%+ a year. Early on, I focused too much on salary. Eventually, I realized total comp (salary, bonuses, RSUs, stock options) was the number that really mattered.

We followed an unwritten rule: switch roles every 2 years. Maybe it’s the ADHD in us. This could mean a lateral move, a promotion, or a new company altogether. Changing roles allowed us to negotiate comp outside of the typical merit cycle. On average, we landed 15% raises with each move instead of the regular 3%.

Beyond salary, we were proactive about discussing bonuses and equity with our managers. We’d work with them to set stretch goals. If we delivered, they’d advocate for more comp. These types of discretionary bonuses often came from separate budgets and were easier to get approved than salary increases.

With this strategy, we averaged 7%+ annual raises over our careers. That growth compounded over time, making our 50% savings rate goal much more achievable.

Real estate:

We took a pragmatic approach to real estate: buy a home to live in, rent it when we moved, and sell it before losing the tax break.

We kept it simple: buy homes we could afford on one salary, live in them first, and never get overleveraged. That meant skipping the nicest houses in the fanciest neighborhoods and focusing on homes that fit our lifestyle, not an investor spreadsheet.

If we could offset the mortgage with a roommate, we did. But, you know… married with kids—that gets awkward fast.

How this played out:

Before kids: we bought a modest home and rented out a room to a friend to help with the mortgage.

As our family grew: we upgraded homes and rented out the old ones. We repeated this three times but never held more than two houses at once—keeping debt low while cashing in gains along the way.

Location luck: Austin wasn’t part of some grand plan, but when it became one of the hottest markets during COVID, it worked in our favor.

Tax smarts: understanding the rules made a big difference. We deducted legitimate rental expenses, learned the difference between passive and active income, and took advantage of the $500K Real Estate Tax Exclusion—meaning no taxes on up to $500K in gains from our primary homes.

There are a lot of ways to invest in real estate—this is just what worked for us: we focused on livability, kept debt in check, understood the tax game, and sold when the market was hot.🔥

There ya have it—by taking advantage of work perks, switching jobs for more cash, and our pragmatic approach to real estate, we were able to increase our income while maintaining a decent work-life balance.

2. Spending with intention, making trade-offs, and getting kickbacks

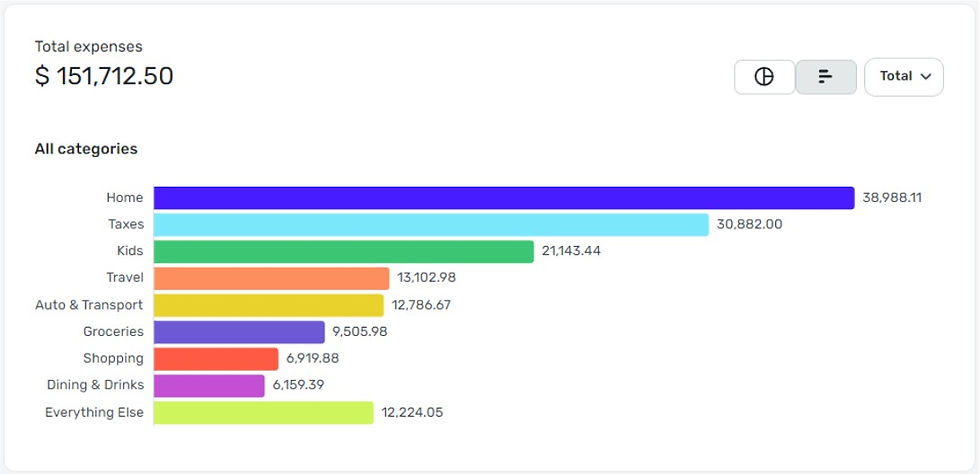

Thanks to Quicken Simplifi, we knew exactly where our money was going. That helped us uncover opportunities to optimize. Here’s how we tackled our spending by the categories in the image above:

Travel: We love to travel, but we looked for ways to keep costs down:

We bought a new $10k pop-up camper for local trips to state and national parks—cheaper than flights/hotels and more fun for the kids. Campsites were ~$30/night.

We leaned hard into travel hacking with the Chase Sapphire Preferred and Capital One Venture X, averaging 4% back in points on all travel.

When we did fly or stay in hotels, we used points + transfer partners to save us ~$10k a year. I’ll dig deeper in a future post.

Dining: After realizing how much we spent eating out, we shifted toward coffee dates over dinner dates. We also used the Chase Sapphire Preferred for 3% back on dining.

Groceries: We opened the Amex Blue card to get 5% back at US grocery stores.

Shopping (Amazon): Like the typical American family, we found ourselves drowning in boxes. We made a conscious effort to cut back on frivolous purchases. Further, we opened the Amazon Prime card giving us 6% back.

Auto & Transport: Driving was non-negotiable (work, daycare, road trips). Instead of cutting back, we got 3% back at gas stations using the Amex Blue card. We also saved some money by buying used cars.

Childcare: The mother of all expenses. With two small children we hired an au pair. It saved us about $10k/year, but… it was a bad experience (smoking doobies at the playground) and we wouldn’t do it again. Still, a win’s a win, lol.

Everything else: The Capital One Venture X gives us 2% back on everything else, which is kinda a small inflation hedge.

For those keeping score, credit cards kick back about ~$13k a year for us; not bad! However, for us, the best way to keep expenses under control is to spend on what matters: travel, good coffee, big steaks, decent childcare, and experiences with our crew.

Naturally, our spending crept up over time, largely due to inflation and having 3 kids. But we stayed focused on avoiding lifestyle inflation. Peer pressure is real—friends and enemies (lol) earning the same we were and spending way more… big houses in the best neighborhoods, sexy cars, and the latest iPhone. It’s hard not to compete. But with our ‘why’ in mind and our FI number within reach, we stayed on our roadmap.

3️. Optimizing taxes to keep more for investing

Taxes are our biggest expense, so it made sense to spend time really learning how the system works:

I hired a CPA (a little pricier than TurboTax) because I wanted to read our taxes line by line and ask a million questions.

I also dove into books and blogs to better understand the basics. Things like the difference between above-the-line deductions, below-the-line deductions, and tax credits. A couple books I recommend:

My biggest realization: the tax code is an incentive system. If you do what the government wants (start a business, buy real estate, get married, have kids, save for retirement, invest in stocks), you pay less in taxes. And ironically, if you’re a W2 employee (like a normal 9-to-5), you’re taxed the most!

Once I understood the rules, I started planning years in advance. Here are the top 3 things we did:

Real Estate Tax Exclusion: We sold 3 houses and paid zero taxes because we followed the $500k primary residence rule—live in the home for 2 of the last 5 years, and you can exclude up to $500k of gains on the sale.

Tax Loss Harvesting: We took advantage of market volatility and created a bank of capital losses to offset gains. Anything unused that year is carried over indefinitely.

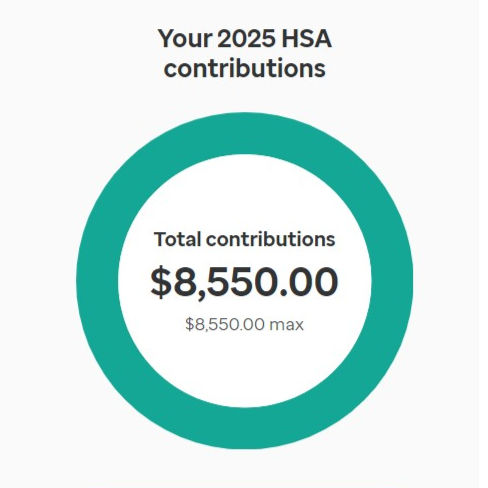

Maxed out tax-advantaged accounts: We maxed out 401ks, HSAs, FSAs to reduce taxes today.

We used to only look at our taxes when filing in April. That’s too late. If we wanted to reduce taxes, we needed to plan years ahead.

Savings = Income - Expenses - Taxes

We took a multi-angle approach to boost our savings rate: increase income, optimize expenses, and reduce taxes. This gave us flexibility. If something didn’t work (side gigs, unexpected expenses like IVF), we had other levers in play (like switching jobs for a 20% raise).

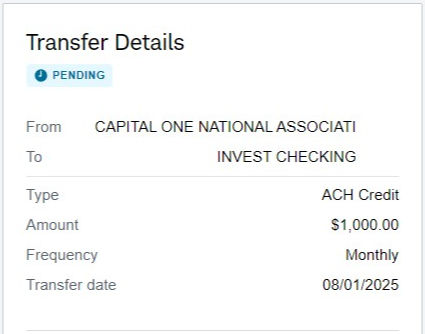

As we optimized these areas, our savings grew and we made sure to invest everything left over. Automation made this easier for us:

401k, HSA, ESPP contributions were deducted before we could even miss it.

Automatic transfers swept money from checking to brokerage to investments.

Whenever our checking balance went above a $20k threshold, we’d invest the excess.

With this approach, we stayed on our roadmap to FI.

This post is part of our 'journey to early retirement' series, sharing our path to Financial Independence (FI) and early retirement with kids.

AI epilogue:

As DJ Khaled would say, another one!

Prompt:

I want to make sure I hit my Financial Independence timeline of 8 years. To do that, I need to make sure I keep my savings rate at 50%. What are some ways I can do that?

Comments