Part 6: tracking financial progress, adjusting as needed, and enjoying the ride

- Vimal Fernandez

- Oct 24, 2025

- 5 min read

Updated: Oct 29, 2025

Disclosure: I’m not a financial advisor. This isn’t financial advice — just what worked for our family. Your financial journey is yours to chart.

Turns out, hitting FI is a lot like hitting puberty—slow, uneventful, and nobody claps when it happens. 🥲🎯🙃

We’ve come a long way. With our ‘why’ tattooed to our buttcheeks and our targets all laid out, we were full steam ahead on the path to FI. We were making and saving more money, and investing like a Wall Street titan.

One small thing: we were still 8 years away.

This part of the journey is what many call “the boring middle.” The grind. The long haul. The stretch where it’s easy to get obsessive, track every penny, and wish the time away—forgetting that this is your one and only life. It doesn’t need to be boring, it can be much more than that.

Let’s dive on in.

Tracking financial progress

Since we were about 8 years away from FI, it made sense to track our progress. We did this through monthly and annual pulse checks.

Monthly: only track spending

Our spending target was $10k/month. We used Quicken Simplifi to track this in real-time. If we saw costs increasing, we’d cut back where it made sense.

We kept investing our monthly savings.

We didn’t flinch when markets dipped. Spending was the only lever we focused on month-to-month. Everything else was out of our hands.

Annually: track income, spending, savings, and net worth

How we got to all the numbers below is covered here.

Income: We aimed to grow income by 3%+ each year, pushing for promotions or job changes every couple of years. It was cool to watch our total comp (salary, stock, 401k match) compound over time. If we didn’t see at least a 3% gain, this served as a reminder to get on it.

Spending: Our annual goal was $120k/year plus ~$10k for travel. We usually came in just over budget. That was fine, we still lived a full life. We looked over how we spent and where we could adjust. We didn’t change the budget for inflation, but we bumped it up anytime we had another kid. Because kids are expensive AF.

Savings: We targeted a 50% after-tax savings rate, and most years, we hit it. If our save rate came in under, we’d dig in to figure out why, then adjust our finances the following year. That didn’t happen often, though, because the biggest driver wasn’t expense cutting, it was income growth. Raises, a large stock vest, or a big ol’ bonus—those were what kept our savings rate on target.

Net worth: While we tracked this, we didn’t set an annual target or make adjustments based on its value. Because once our portfolio grew, market returns start dominating and those are out of our control. But man, watching compounding kick in was wild. Slow at first, then flip-the-table explosive. That exponential curve is real.

And then lastly, we calculated how far we were from FI

I kept this super simple. This is all far-out forecasting. We don’t know what’s gonna happen 5+ years out, so no need to stress over a thousand variables just these: Net worth. Expenses. Savings. That’s it.

I used investor.gov's calculator plugging in our numbers and a few basic assumptions:

Initial Investment = Net worth = $1M

Monthly Contribution = Monthly savings = $10k

Estimated Interest Rate = S&P 500 return = 10%

Future Value = FI number = $3M

I tweaked “Length of Time in Years” until the future value hit $3M (our FI number). Boom! Turns out, in this case, we were about 7 years away. Most years, we got closer. A couple years, we drifted. It’s all part of the ride. If you want to go deeper, I’ve played around with tools like: FireCalc, Portfolio Visualizer. We didn’t need fancy. We just needed a gut check: are we roughly on track or not?

Adjusting our plan

Life happens—kids, COVID, job changes, windfalls—and we adjusted the plan as we went. It was never static. Here are two examples:

Having a third kid: A couple years out from FI my wife strong-armed me into having a third kid. Our original plan was to hit our FI number and retire soon after. But baby #3 pushed things out by two years. Partly to take advantage of parental leave and partly to let life settle a bit. We wanted our third daughter to hit age two before we quit work.

Temporary expenses: Sometimes our costs spiked fast. One summer, we had three kids in daycare at the same time. That was an extra $4,000/month. Brutal. We paid it, moved on, and didn’t beat ourselves up over it. We adjusted temporary expenses out of our FI number because they would fall off. No need to inflate our FI number for expenses that wouldn’t stick around.

The plan is the plan until the plan changes: We didn’t get too hung up on the number of years to FI or the exact dollar amount we needed. Those were just rough guideposts. The only time those numbers really mattered was when we were about to make a big decision, like cutting back work or walking away completely. Instead, we stayed focused on our bigger goals—our ‘why’ and savings rate—and trusted that we’d get to FI eventually.

The “boring middle” aka the “sweet spot”

Now that we’re FI, I can confirm: our day-to-day didn’t change immediately when we hit it. Sure, there was a quiet sense of joy, some relief, a little “we did it” moment but then life just… kept going. We went to work the next day. I was probably stressed about something. Pretty sure I was late picking up the kids from daycare.

And that’s okay.

Because we generally liked our life. We had three amazing daughters who were mostly fun to be around. Our marriage was solid-ish. We were close to family, had good friends, enjoyed our jobs, and were healthy. Life was good.

So no, FI didn’t come with confetti or applause or some magical moment where all our problems disappeared. And it never was going to. And that’s a really important realization.

We were lucky we made the choices to build a life that was fulfilling, fun, and meaningful before we hit FI. Yeah, we had tough times. Stress. Late nights. Arguments. Missed goals. And we didn’t knock out every piece of our ‘why.’ But there was way more good than bad.

Looking back, we unknowingly rebranded our so-called “boring middle” as the “sweet spot.” We weren’t waiting to live after FI, we were living our ‘why’ the whole way there.

Not forgetting the fundamentals

Things will change, dates will move, targets will shift. Missing a goal can cause major disappointment and kill your motivation. Expecting change softens the blow and keeps you going.

Keep it simple. We focused our energy on earning more, spending less, and investing the rest. Everything else falls into place.

Live life now. The milestone of FI didn’t bring us immediate happiness but doing our best to live out our ‘why’ along the way did.

I still remember when FI was 8 years away… and then suddenly, it was behind us. Time flies when you’re living your ‘why’.

Want to go deeper? These books helped shape our mindset and our plan: The Simple Path to Wealth and Quit Like a Millionaire. Highly recommend for any family on the road to FI.

Next up: Part 7: Managing our money after FI

This post is part of our 'journey to early retirement' series, sharing our path to Financial Independence (FI) and early retirement with kids.

AI epilogue:

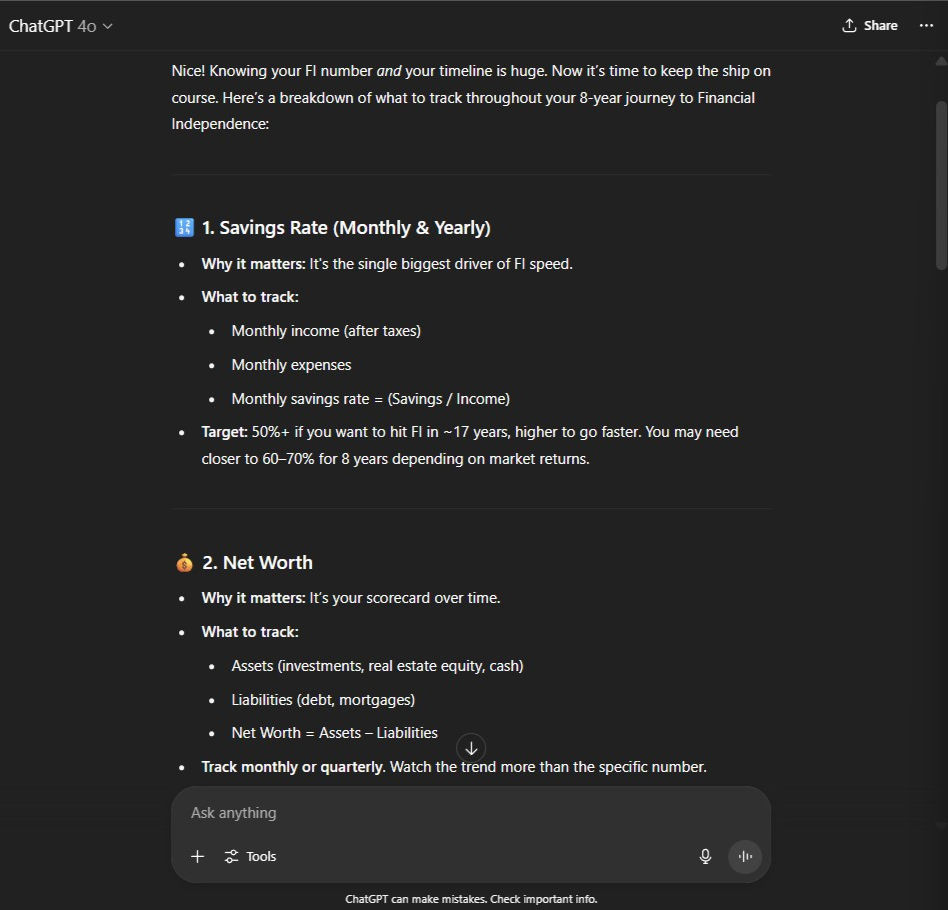

Since we have plenty of time on our path to FI, why not ask AI how to stay on track?

Prompt:

I have my FI number, it’s 8 years away. What are some things I can track throughout my journey to make sure I'm doing my best to stay on track?

Comments